Risk Assessment Matrix Analysis is a crucial tool used in risk management to evaluate and prioritize potential risks. By providing a systematic approach to risk assessment, it allows businesses to identify and mitigate potential threats effectively. In this article, we will delve into the basics of Risk Assessment Matrix Analysis, the steps involved, how to interpret the results, common mistakes to avoid, and best practices for conducting an effective analysis.

Understanding the Basics of Risk Assessment Matrix

Before we dive into the intricacies of Risk Assessment Matrix Analysis, let’s explore its definition and importance. A Risk Assessment Matrix is a visual representation of the potential risks a business may encounter. It helps organizations categorize and prioritize risks based on their severity and likelihood of occurrence. This allows businesses to allocate resources efficiently and implement appropriate risk mitigation strategies.

Classification of risks

When it comes to risk assessment, it is crucial to have a comprehensive understanding of the key components of a Risk Assessment Matrix. One of these components is the classification of risks into different categories. By classifying risks, businesses can gain a clearer perspective on the types of risks they are facing. This categorization can range from financial risks, operational risks, legal risks, to reputational risks. Each category may require different approaches and strategies to mitigate and manage.

Establishment of risk levels

Another important component of a Risk Assessment Matrix is the establishment of risk levels based on predetermined criteria. This involves determining the severity and likelihood of each risk. Severity refers to the potential impact a risk can have on the business, while likelihood refers to the probability of the risk occurring. By assigning risk levels, businesses can prioritize their focus and resources on the risks that pose the greatest threat.

Structured framework for evaluating risks

Now, let’s delve deeper into how the Risk Assessment Matrix provides a structured framework for evaluating risks. The matrix assigns scores or ratings to each risk based on its impact and probability. These scores can be represented in a matrix format, with severity levels on one axis and likelihood levels on the other. By plotting risks on this matrix, businesses can visually identify the risks that fall into high-impact and high-probability areas, which require immediate attention.

Risk mitigation strategies

Furthermore, the Risk Assessment Matrix allows businesses to assess the effectiveness of their risk mitigation strategies. By regularly reviewing and updating the matrix, organizations can track the progress of their risk management efforts. This enables them to make informed decisions on whether to adjust existing strategies or implement new ones.

In conclusion, a Risk Assessment Matrix is a powerful tool that enables businesses to proactively identify, assess, and manage risks. By classifying risks, establishing risk levels, and providing a structured framework for evaluation, the matrix empowers organizations to allocate resources efficiently and implement effective risk mitigation strategies. It is an essential component of any robust risk management framework, helping businesses navigate uncertainties and safeguard their success.

Steps to Conduct a Risk Assessment Matrix Analysis

Conducting a comprehensive Risk Assessment Matrix Analysis involves several key steps. Let’s examine each step in detail below.

Identifying Potential Risks

The first step in the analysis is to identify all potential risks that could adversely impact the organization. This includes conducting a thorough assessment of internal and external factors that may pose a threat to the business. It is crucial to involve all relevant stakeholders to ensure a comprehensive list of potential risks.

During the process of identifying potential risks, it is important to consider various aspects such as financial risks, operational risks, legal and regulatory risks, technological risks, and reputational risks. By considering these different categories, organizations can ensure that no significant risk is overlooked.

Furthermore, it is essential to gather data and information from various sources such as historical records, industry reports, expert opinions, and internal documentation. This helps in obtaining a holistic view of the potential risks and their impact on the organization.

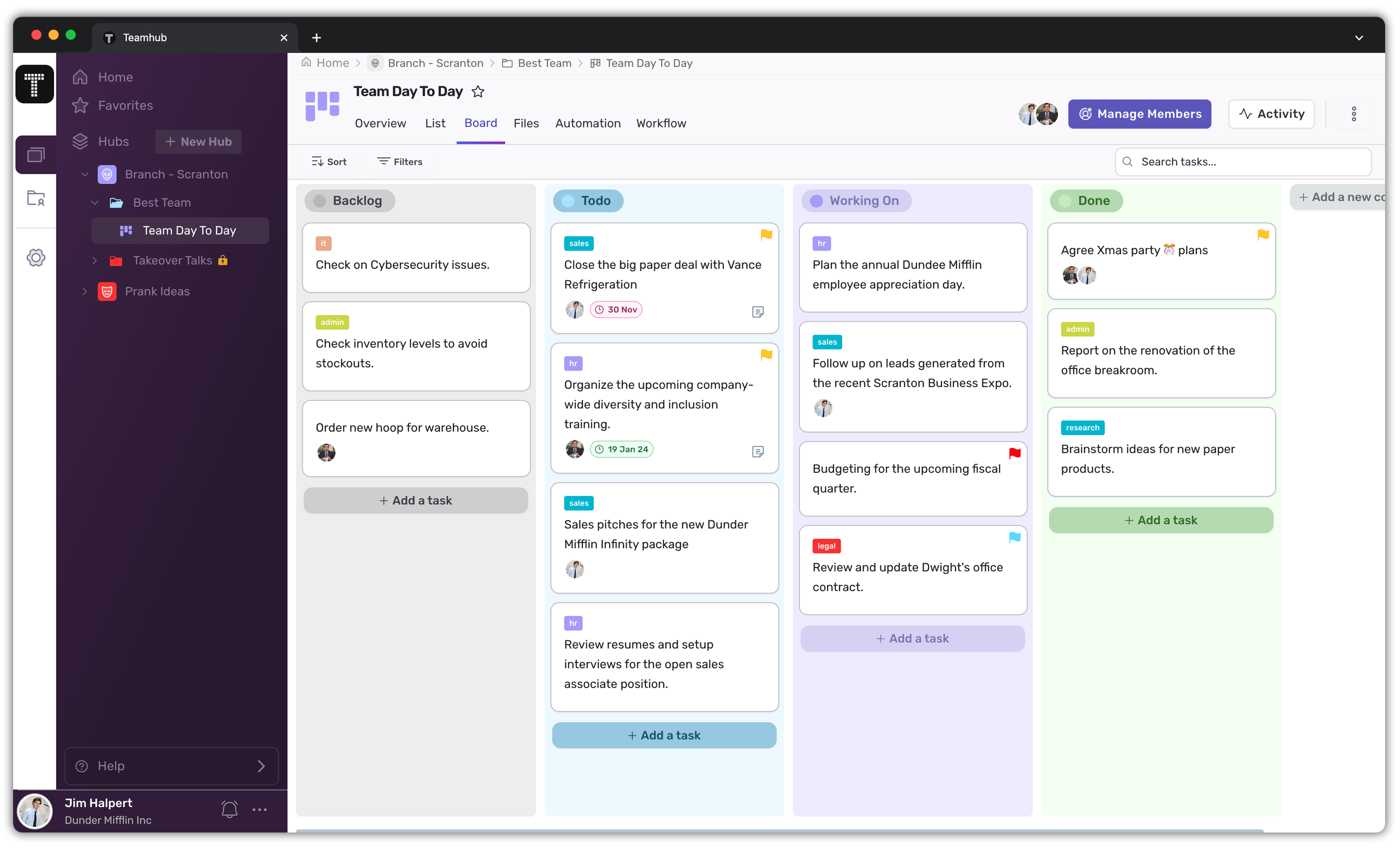

Unlock Efficiency with Teamhub

Evaluating the Severity and Likelihood of Risks

Once all potential risks are identified, the next step is to evaluate their severity and likelihood. Severity refers to the potential impact or harm caused by a specific risk, while likelihood represents the chances of the risk occurring.

During the evaluation process, organizations can utilize various techniques such as qualitative analysis, quantitative analysis, and risk scoring models. These techniques help in assigning appropriate levels to each risk, considering their potential consequences and probability of occurrence.

Additionally, organizations can also consider the interdependencies between different risks. Some risks may have a cascading effect, where the occurrence of one risk can trigger or exacerbate other risks. By understanding these interdependencies, organizations can better assess the overall impact of the risks and prioritize their mitigation efforts accordingly.

Prioritizing Risks Based on Assessment

After evaluating the severity and likelihood of risks, it is crucial to prioritize them based on the assessment results. This allows businesses to focus their resources and attention on the most critical risks that require immediate attention.

During the prioritization process, organizations can consider various factors such as the potential impact on business objectives, the urgency of mitigation, the availability of resources, and the organization’s risk appetite. By considering these factors, organizations can develop a risk prioritization framework that aligns with their strategic goals and objectives.

Furthermore, organizations can also consider the effectiveness and feasibility of different mitigation measures when prioritizing risks. Some risks may have readily available and cost-effective mitigation strategies, while others may require more complex and resource-intensive solutions. By considering these aspects, organizations can make informed decisions about the order in which risks should be addressed.

In conclusion, conducting a Risk Assessment Matrix Analysis involves a systematic and comprehensive approach to identify, evaluate, and prioritize potential risks. By following these steps, organizations can gain valuable insights into their risk landscape and develop effective risk management strategies.

Interpreting Risk Assessment Matrix Results

Understanding the results of a Risk Assessment Matrix is vital for effective decision-making. Let’s explore how to interpret the results below.

When analyzing the risk ratings in a Risk Assessment Matrix, it is important to consider the context in which they are presented. Risk ratings are typically depicted using a color-coded system or numerical scale, providing businesses with a visual representation of the severity and likelihood of risks. This allows organizations to prioritize their actions accordingly, ensuring that resources are allocated to address the most critical risks first.

High-risk ratings in a Risk Assessment Matrix indicate a high probability of occurrence and severe consequences. These risks demand immediate attention and require businesses to implement robust risk mitigation strategies. By identifying and addressing high-risk areas, organizations can minimize the potential impact on their operations and protect their assets.

On the other hand, low-risk ratings in a Risk Assessment Matrix indicate risks that are less likely to occur and have minimal impact. While these risks may not require immediate action, it is still important for businesses to monitor them and have contingency plans in place. By staying vigilant and prepared, organizations can effectively manage low-risk areas and prevent them from escalating into more significant issues.

Understanding Risk Ratings

Risk ratings in a Risk Assessment Matrix are typically depicted using a color-coded system or numerical scale. These ratings provide insights into the severity and likelihood of risks, allowing businesses to prioritize their actions accordingly. High-risk ratings indicate a high probability of occurrence and severe consequences, demanding immediate attention, while low-risk ratings indicate risks that are less likely to occur and have minimal impact.

By assigning risk ratings, businesses can gain a comprehensive understanding of the potential threats they face. This enables them to allocate resources effectively, ensuring that the necessary measures are in place to mitigate risks. Additionally, risk ratings serve as a valuable tool for communication within organizations, enabling stakeholders to easily grasp the level of risk associated with specific areas or activities.

It is important to note that risk ratings should not be viewed in isolation. They should be considered alongside other factors, such as the organization’s risk appetite, industry standards, and regulatory requirements. By taking a holistic approach to risk assessment, businesses can make well-informed decisions and develop comprehensive risk management strategies.

Making Decisions Based on Risk Assessment

Once risk ratings are determined, businesses can use the information to make informed decisions. This includes implementing risk mitigation strategies, allocating resources effectively, and investing in preventive measures. By relying on the Risk Assessment Matrix results, organizations can prioritize risk management efforts and devise appropriate action plans.

When making decisions based on risk assessment, it is crucial for businesses to consider the potential impact of their actions. This involves evaluating the effectiveness of different risk mitigation strategies and weighing them against the associated costs and benefits. By conducting a cost-benefit analysis, organizations can ensure that their decisions align with their overall objectives and maximize the value of their risk management efforts.

Furthermore, risk assessment should be an ongoing process. As the business landscape evolves, new risks may emerge, and existing risks may change in severity or likelihood. Therefore, it is important for organizations to regularly review and update their Risk Assessment Matrix to ensure that it remains relevant and effective.

Common Mistakes in Risk Assessment Matrix Analysis

While Risk Assessment Matrix Analysis is a valuable tool in risk management, it is essential to be aware of common pitfalls that may hinder its effectiveness. Let’s explore some common mistakes to avoid.

Overlooking Certain Risks

One common mistake is overlooking certain risks or focusing only on the most obvious ones. To conduct a comprehensive analysis, organizations must consider all potential risks, including those that may be less apparent. By involving a diverse team with different perspectives, organizations can ensure a thorough evaluation of all risks.

Misjudging the Severity or Likelihood of Risks

Misjudging the severity or likelihood of risks can lead to an incorrect prioritization of resources. It is crucial to rely on accurate data and expert opinions when assessing risks. Objectivity and thorough analysis are key to avoid misjudgment and ensure that the Risk Assessment Matrix accurately reflects the potential impact of each risk.

Best Practices for Effective Risk Assessment Matrix Analysis

To enhance the effectiveness of Risk Assessment Matrix Analysis, organizations can implement the following best practices.

Regularly Updating the Risk Assessment Matrix

Risks are dynamic and ever-evolving, and therefore, it is crucial to regularly update the Risk Assessment Matrix. By reviewing and updating the matrix periodically, organizations can account for new risks, changes in the business environment, and the effectiveness of previously implemented risk mitigation measures.

Involving a Diverse Team in the Risk Assessment Process

When conducting a Risk Assessment Matrix Analysis, it is beneficial to involve a diverse team with various areas of expertise. Different perspectives can help uncover potential risks that may be overlooked by a single individual or department. Collaboration among team members ensures a comprehensive evaluation of risks and promotes a more accurate analysis.

Using a Standardized Approach for Consistency

Consistency is key in risk assessment to ensure accurate and comparable results. Organizations should develop a standardized approach for conducting Risk Assessment Matrix Analysis. This involves establishing clear criteria, rating scales, and guidelines for consistently assessing and categorizing risks. By using a standardized approach, organizations can ensure consistent and reliable risk assessment results.

In conclusion, Risk Assessment Matrix Analysis is a valuable tool for businesses to identify, evaluate, and prioritize potential risks. By following the steps outlined in this article, understanding the interpretation of results, avoiding common mistakes, and implementing best practices, organizations can conduct a robust and effective analysis. Through informed decision-making based on the Risk Assessment Matrix, businesses can proactively manage risks and safeguard their future success.