In the field of procurement, understanding the various costs involved is crucial for effective decision-making and budgeting. By accurately calculating procurement costs, businesses can ensure that their purchasing activities are cost-effective and contribute to overall financial stability.

Understanding the Basics of Procurement Cost

When we talk about procurement cost, we refer to the total expenses incurred during the procurement process. It goes beyond the purchase price of goods or services and includes various direct and indirect costs.

Procurement cost encompasses all the expenses associated with acquiring goods or services from external suppliers. These costs can include purchase price, transportation costs, taxes and duties, storage costs, and any other expenses directly related to the procurement process.

But what exactly do these costs entail? Let’s delve deeper into the different components of procurement cost.

Definition of Procurement Cost

Procurement cost is a comprehensive term that encompasses various aspects of the procurement process. It includes not only the actual purchase price of the goods or services but also the costs incurred before, during, and after the acquisition.

One of the major components of procurement cost is transportation costs. This includes the expenses associated with shipping the goods from the supplier’s location to the buyer’s premises. Whether it’s by land, sea, or air, transportation costs can significantly impact the overall procurement cost.

In addition to transportation costs, taxes and duties also form an integral part of procurement cost. Depending on the country of origin and destination, there may be import or export duties, customs fees, and other taxes that need to be accounted for. These costs can vary greatly and must be considered when calculating the total procurement cost.

Furthermore, storage costs are another significant element of procurement cost. If the goods need to be stored before they are used or sold, expenses such as warehousing, inventory management, and insurance must be taken into account. These costs can add up over time and should not be overlooked in the overall procurement cost calculation.

Importance of Accurate Procurement Cost Calculation

Accurate procurement cost calculation is essential for several reasons. Firstly, it helps businesses evaluate the true cost of acquiring goods or services, allowing for better budgeting and financial planning. By considering all the different components of procurement cost, organizations can gain a more accurate understanding of the financial impact of their procurement activities.

Secondly, accurate cost calculation enables organizations to identify cost-saving opportunities and optimize their procurement strategies. By analyzing the different cost elements, businesses can identify areas where they can negotiate better prices, streamline processes, or find more cost-effective suppliers. This can lead to significant savings and improved overall efficiency.

Finally, accurate cost calculation provides a basis for negotiation with suppliers, ensuring that the agreed-upon prices are fair and reasonable. Armed with a thorough understanding of the procurement cost, organizations can engage in meaningful discussions with suppliers, aiming for mutually beneficial agreements. This transparency helps build trust and fosters long-term relationships with suppliers.

In conclusion, procurement cost is a multifaceted concept that goes beyond the purchase price. It includes transportation costs, taxes and duties, storage costs, and other expenses directly related to the procurement process. Accurate cost calculation is crucial for budgeting, identifying cost-saving opportunities, and negotiating fair prices with suppliers. By understanding the various components of procurement cost, businesses can make informed decisions and optimize their procurement strategies.

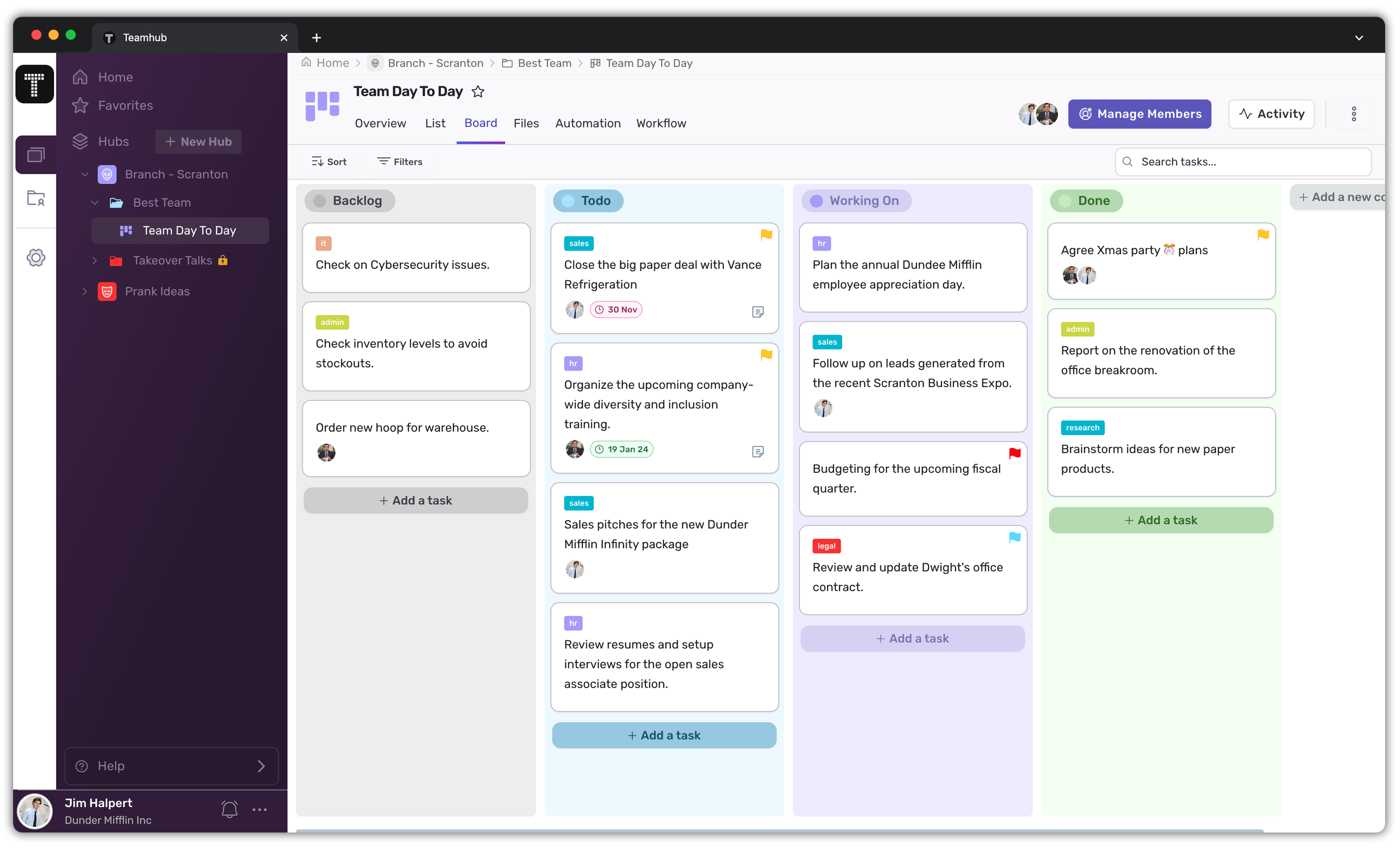

Unlock Efficiency with Teamhub

Components of Procurement Cost

Procurement cost can be divided into two main components: direct costs and indirect costs.

Direct cost

Direct costs are the expenses that can be directly attributed to the procurement of specific goods or services. These costs typically include the purchase price, transportation costs, packaging costs, and any duties or taxes incurred during the importation process.

When it comes to the purchase price, it is important to consider factors such as quantity discounts, volume pricing, and negotiated discounts. Transportation costs can vary depending on the distance between the supplier and the buyer, the mode of transportation chosen, and any additional services required, such as insurance or tracking. Packaging costs may include materials, labor, and any specialized packaging required to ensure the safe delivery of the goods. Duties and taxes incurred during the importation process can significantly impact the overall procurement cost, and it is essential to understand the applicable regulations and calculate these costs accurately.

Indirect cost

Indirect costs, also known as overhead costs, are the expenses that support the overall procurement operations but cannot be directly linked to specific purchases. These costs include salaries of procurement staff, rent and utilities for procurement facilities, technology and software investments, and other administrative expenses.

Procurement staff plays a crucial role in the procurement process, from identifying potential suppliers to negotiating contracts and managing relationships. Their salaries, along with any benefits and incentives, contribute to the indirect costs. Rent and utilities for procurement facilities, such as warehouses or offices, are necessary to store and manage the procured goods. Technology and software investments enable efficient procurement operations, including e-procurement systems, supplier relationship management tools, and data analytics software. Other administrative expenses, such as office supplies and training programs, also fall under the category of indirect costs.

Understanding the components of procurement cost is essential for effective cost management and budgeting. By analyzing both direct and indirect costs, organizations can identify areas for optimization, negotiate better terms with suppliers, and ensure the overall efficiency of their procurement operations.

Steps in Calculating Procurement Costs

Calculating procurement costs involves several steps to ensure accuracy and comprehensive analysis.

Procurement costs play a critical role in the financial health of a business. By accurately calculating these costs, organizations can make informed decisions, optimize their procurement processes, and identify areas for cost reduction. Let’s explore the steps involved in calculating procurement costs in more detail.

Identifying Relevant Costs

The first step in calculating procurement costs is to identify all the relevant costs associated with the procurement process. This includes both direct and indirect costs. Direct costs are expenses that can be directly attributed to a specific purchase. This includes the cost of raw materials or the price of a service. Indirect costs, on the other hand, are expenses that are not directly tied to a specific purchase but are still necessary for the procurement process to take place. These may include overhead costs, such as rent, utilities, or salaries of procurement staff.

It is important to consider all expenses from the initial request for proposal (RFP) to the final delivery of the goods or services. This includes costs incurred during the supplier selection process, contract negotiation, transportation, and any additional fees or taxes associated with the procurement.

Allocating Costs

Once all the relevant costs have been identified, they need to be allocated to the corresponding purchases. This requires a thorough understanding of the procurement process and the ability to assign costs accurately to each transaction. Cost allocation ensures that the true cost of each purchase is reflected in the overall calculations.

Cost allocation methods may vary depending on the nature of the procurement. For example, in a manufacturing company, the cost of raw materials may be allocated based on the quantity used in each product. In a service-based organization. Costs may be allocated based on the time spent on each project or the number of clients served.

Accurate cost allocation is crucial for businesses to have a clear understanding of the financial impact of each purchase and to make informed decisions regarding pricing, supplier selection, and overall procurement strategy.

Summing Up the Costs

After allocating costs, the next step is to sum up all the identified costs. This allows businesses to determine the total procurement cost of a specific purchase or the entire procurement process. Summing up the costs provides a clear overview of the financial impact of procurement activities and helps identify areas for potential cost reduction.

By analyzing the total procurement costs, organizations can identify trends, patterns, and potential cost-saving opportunities. This information can be used to negotiate better prices with suppliers, streamline procurement processes, or explore alternative sourcing options.

Furthermore, summing up the costs enables businesses to evaluate the effectiveness of their procurement strategies and make data-driven decisions to optimize their procurement operations.

In conclusion, calculating procurement costs is a crucial step for businesses to gain insights into their financial performance and make informed decisions. By identifying relevant costs, accurately allocating them, and summing up the overall expenses, organizations can optimize their procurement processes, reduce costs, and ultimately improve their bottom line.

Common Mistakes in Procurement Cost Calculation

While accurate procurement cost calculation is crucial, there are common mistakes that businesses should be aware of and avoid.

Procurement cost calculation plays a vital role in determining the financial health of a business. It helps organizations understand the true expenses incurred during the procurement process and enables them to make informed decisions. However, there are certain pitfalls that businesses often fall into, leading to inaccurate calculations and potentially harmful consequences.

Overlooking Indirect Costs

One common mistake is overlooking indirect costs in procurement cost calculations. Indirect costs refer to expenses that are not directly associated with a specific purchase but are still incurred during the procurement process. These costs can include administrative expenses, transportation costs, storage costs, and even the cost of maintaining relationships with suppliers. Focusing solely on direct costs, such as the purchase price of goods or services, can lead to an inaccurate representation of the total expenses incurred during the procurement process. Considering indirect costs is essential for a comprehensive analysis of the true cost of procurement.

For example, failing to account for transportation costs can result in underestimating the total cost of procuring goods from a distant supplier. Similarly, neglecting to include storage costs can lead to unforeseen expenses down the line. This is especially if the goods need to be stored for an extended period before being utilized.

Misallocation of Costs

Another mistake is the misallocation of costs. Proper allocation ensures that each purchase is assigned the correct expenses, allowing for accurate cost calculations. Failure to allocate costs accurately can distort the calculations and provide misleading information, leading to poor decision-making.

For instance, if the costs associated with a particular purchase are allocated to the wrong department or project, it can skew the overall cost analysis. This can result in incorrect budgeting, inefficient resource allocation, and ultimately affect the profitability of the organization. Therefore, it is crucial to establish a robust system for cost allocation, ensuring that expenses are correctly assigned to the relevant purchases.

Moreover, misallocation of costs can also have legal implications. In some industries, there are strict regulations regarding cost allocation, and non-compliance can lead to penalties and legal consequences. Therefore, it is imperative for businesses to diligently follow proper cost allocation practices to avoid any legal complications.

In conclusion, accurate procurement cost calculation is essential for businesses to make informed decisions and maintain financial stability. By avoiding common mistakes such as overlooking indirect costs and misallocating expenses, organizations can ensure that their cost calculations are comprehensive and accurate. This, in turn, will enable them to optimize their procurement processes and drive overall efficiency and profitability.

Strategies for Reducing Procurement Costs

Reducing procurement costs is a constant objective for businesses, as it directly impacts profitability and financial performance. Here are some strategies to achieve cost reduction.

Leveraging Technology for Cost Reduction

One effective strategy is to leverage technology for cost reduction. Implementing e-procurement systems, automated bidding processes, and advanced analytics can streamline procurement operations, improve efficiency, and reduce costs.

Negotiating with Suppliers

Negotiating with suppliers is a critical aspect of cost reduction. By negotiating favorable terms, businesses can secure better prices, discounts, and favorable payment terms. Building strong and collaborative relationships with suppliers can lead to long-term cost savings.

Streamlining Procurement Processes

Streamlining procurement processes is essential for efficiency and cost reduction. By identifying bottlenecks, eliminating unnecessary steps, and improving communication and coordination, businesses can optimize their procurement operations and reduce costs.

In conclusion, accurate procurement cost calculation is crucial for businesses to make informed decisions and effectively manage their budget. By understanding the basics of procurement cost, including direct and indirect costs, and following the steps in calculating procurement costs, organizations can optimize their procurement strategies and achieve cost savings. Avoiding common mistakes in cost calculation and implementing cost reduction strategies, such as leveraging technology and negotiating with suppliers, further contribute to improving financial performance. By continuously monitoring and analyzing procurement costs, businesses can ensure their purchasing activities align with overall financial goals and contribute to long-term success.

0 thoughts on “Procurement Cost Calculation Explained”