In today’s rapidly evolving business landscape, the fintech industry has emerged as a key player. Fintech, short for financial technology, refers to the innovative use of technology in the design and delivery of financial services. This article will explore the importance of project management strategies for fintech companies, highlighting the unique characteristics of the industry and the role of technology in driving its growth.

Understanding the Fintech Industry

Before delving into project management strategies, it is essential to have a solid understanding of the fintech industry. Fintech companies leverage technology to provide financial services that are faster, more efficient, and more accessible than traditional financial institutions. These companies disrupt the traditional finance sector by offering innovative solutions in areas such as payments, lending, wealth management, and insurance.

In order to fully grasp the intricacies of the fintech industry, it is important to explore the key characteristics that differentiate it from traditional finance. These characteristics shed light on the unique nature of the industry and the factors that contribute to its rapid growth and success.

Key Characteristics of the Fintech Industry

The fintech industry is characterized by several key factors that differentiate it from traditional finance:

- Rapid Innovation: Fintech companies thrive on continuous innovation and technological advancements. The industry is constantly evolving, driven by changing customer expectations and emerging technologies. This constant drive for innovation ensures that fintech companies stay ahead of the curve and deliver cutting-edge solutions to their customers.

- Disruptive Potential: Fintech companies have the ability to disrupt traditional financial institutions by offering innovative products and services at a lower cost and with better user experiences. By leveraging technology, fintech companies can challenge the status quo and provide alternatives that are more convenient, efficient, and tailored to the needs of modern consumers.

- Regulatory Challenges: Fintech companies need to navigate complex regulatory landscapes to ensure compliance with financial regulations. As technology continues to advance, regulators are faced with the challenge of keeping up with the pace of innovation. Fintech companies must work closely with regulatory bodies to ensure that their operations are in line with the necessary legal and compliance requirements.

- Digital Transformation: Fintech companies leverage digital technologies such as artificial intelligence, blockchain, and cloud computing to deliver their services. These technologies enable fintech companies to automate processes, improve efficiency, and enhance the overall customer experience. By embracing digital transformation, fintech companies are able to offer innovative solutions that were previously unimaginable.

Understanding these key characteristics of the fintech industry provides valuable insights into the dynamics and potential of this rapidly growing sector. However, it is equally important to recognize the pivotal role that technology plays in driving the growth and success of fintech companies.

The Role of Technology in Fintech

Technology plays a crucial role in driving the growth of the fintech industry. It enables companies to offer innovative financial solutions, automate processes, and enhance customer experiences. The integration of technology into the core operations of fintech companies has revolutionized the way financial services are delivered and consumed.

Streamlining their operations

One of the primary ways in which technology empowers fintech companies is by streamlining their operations. Through the use of automation and data analytics, fintech companies are able to optimize their processes, improve efficiency, and reduce costs. By automating repetitive tasks and leveraging data-driven insights, fintech companies can focus their resources on delivering high-value services and solutions to their customers.

Enhancing the security

In addition to streamlining operations, technology also plays a vital role in enhancing the security of fintech companies. With the increasing prevalence of cyber threats, it is imperative for fintech companies to prioritize the security and privacy of customer data. By utilizing advanced cybersecurity technologies, such as encryption and multi-factor authentication, fintech companies can safeguard sensitive information and build trust with their customers.

Accessibility to financial services

Furthermore, technology enables fintech companies to improve accessibility to financial services. Through the use of mobile and online platforms, fintech companies are able to reach a broader range of individuals, including the unbanked and underbanked populations. By providing user-friendly interfaces and intuitive mobile applications, fintech companies are breaking down barriers and making financial services more accessible to all.

Technology-enabled solutions

Lastly, technology-enabled solutions are instrumental in enabling financial inclusion. Fintech companies leverage technology to provide individuals and businesses with access to financial services that were previously unavailable or inaccessible. Whether it is through peer-to-peer lending platforms, digital wallets, or micro-investment apps, fintech companies are empowering individuals to take control of their finances and participate in the global economy.

In conclusion, the fintech industry is a rapidly evolving sector that leverages technology to provide innovative financial solutions. By understanding the key characteristics of the industry and recognizing the role of technology in driving its growth, we can appreciate the transformative impact that fintech companies have on the financial landscape.

Unlock Efficiency with Teamhub

The Importance of Project Management in Fintech

Effective project management is crucial for fintech companies to successfully deliver their innovative solutions. It ensures that projects are executed efficiently, meet business objectives, and comply with regulatory requirements.

In the fast-paced and ever-evolving world of fintech, project management plays a pivotal role in driving success. By effectively managing projects, fintech companies can navigate the complexities of the industry, overcome challenges, and seize opportunities for growth and innovation.

Aligning Project Goals with Business Objectives

Aligning project goals with business objectives is a critical aspect of project management in the fintech industry. Fintech companies need to ensure that project activities support their overall business strategy and contribute to their long-term success.

When project goals are aligned with business objectives, fintech companies can unlock a multitude of benefits:

- Drive Innovation: Project management enables fintech companies to execute innovative projects that differentiate them from competitors and drive industry advancements. By setting clear goals and timelines, project managers can foster a culture of creativity and encourage teams to think outside the box.

- Maximize Efficiency: Well-defined project goals help fintech companies focus on delivering projects within budget and schedule, optimizing resource allocation, and reducing wastage. Through effective project management, companies can streamline processes, identify bottlenecks, and implement strategies to enhance operational efficiency.

- Enhance Customer Experience: Project management ensures that projects are designed and executed with the end-user in mind, delivering exceptional customer experiences. By conducting thorough market research, gathering user feedback, and incorporating customer-centric design principles, fintech companies can create solutions that truly meet the needs and expectations of their target audience.

By aligning project goals with business objectives, fintech companies can establish a solid foundation for success, ensuring that every project undertaken contributes to their overall growth and profitability.

Ensuring Regulatory Compliance in Projects

Regulatory compliance is a significant challenge for fintech companies due to the evolving nature of financial regulations. Effective project management includes ensuring that projects adhere to relevant legal and regulatory requirements.

In an industry where compliance is not just a necessity but a fundamental requirement, project managers play a crucial role in safeguarding the integrity and reputation of fintech companies. By incorporating compliance considerations into every stage of the project lifecycle, they can mitigate risks and ensure adherence to regulatory standards.

Ensuring regulatory compliance in projects involves:

Understanding the Regulatory Landscape

Fintech companies must stay up to date with financial regulations to ensure their projects comply with relevant laws and industry standards. This requires continuous monitoring of regulatory changes, engaging with regulatory bodies, and establishing robust compliance frameworks.

Implementing Risk Management Practices

Project management involves identifying and mitigating potential regulatory risks through appropriate risk management strategies and controls. By conducting thorough risk assessments, project managers can proactively address compliance challenges and implement measures to minimize the impact of regulatory changes.

Engaging Legal Expertise

Fintech companies should involve legal experts throughout project lifecycles to navigate regulatory complexities and ensure compliance. These experts can provide valuable insights, interpret regulatory requirements, and guide project teams in making informed decisions that align with legal obligations.

By integrating regulatory compliance into project management practices, fintech companies can build trust with stakeholders, maintain a strong reputation, and avoid costly penalties or legal repercussions.

In conclusion, project management is an indispensable component of success in the fintech industry. It enables companies to align their projects with business objectives, drive innovation, maximize efficiency, enhance customer experiences, and ensure regulatory compliance. By embracing effective project management practices, fintech companies can navigate the dynamic landscape of the industry, overcome challenges, and achieve sustainable growth.

Agile project management in fintech

Agile project management is a highly flexible and iterative approach that is widely adopted in the fintech industry. It emphasizes collaboration, adaptability, and continuous improvement throughout the project lifecycle. In Agile project management, the project is divided into smaller, manageable tasks called user stories, which are prioritized and completed in short iterations called sprints.

One of the key advantages of Agile project management in the fintech industry is its ability to quickly respond to changing market needs and customer requirements. As the fintech landscape is constantly evolving, being able to adapt and deliver incremental value to customers is crucial for success. Agile project management allows teams to regularly review and incorporate feedback, ensuring that the final product meets the needs of the end-users.

Another benefit of Agile project management is its focus on collaboration and cross-functional teams. In the fintech industry, projects often require expertise from various domains such as software development, data analytics, and financial services. Agile project management encourages close collaboration between team members. It enables them to leverage their diverse skills and knowledge to deliver high-quality results.

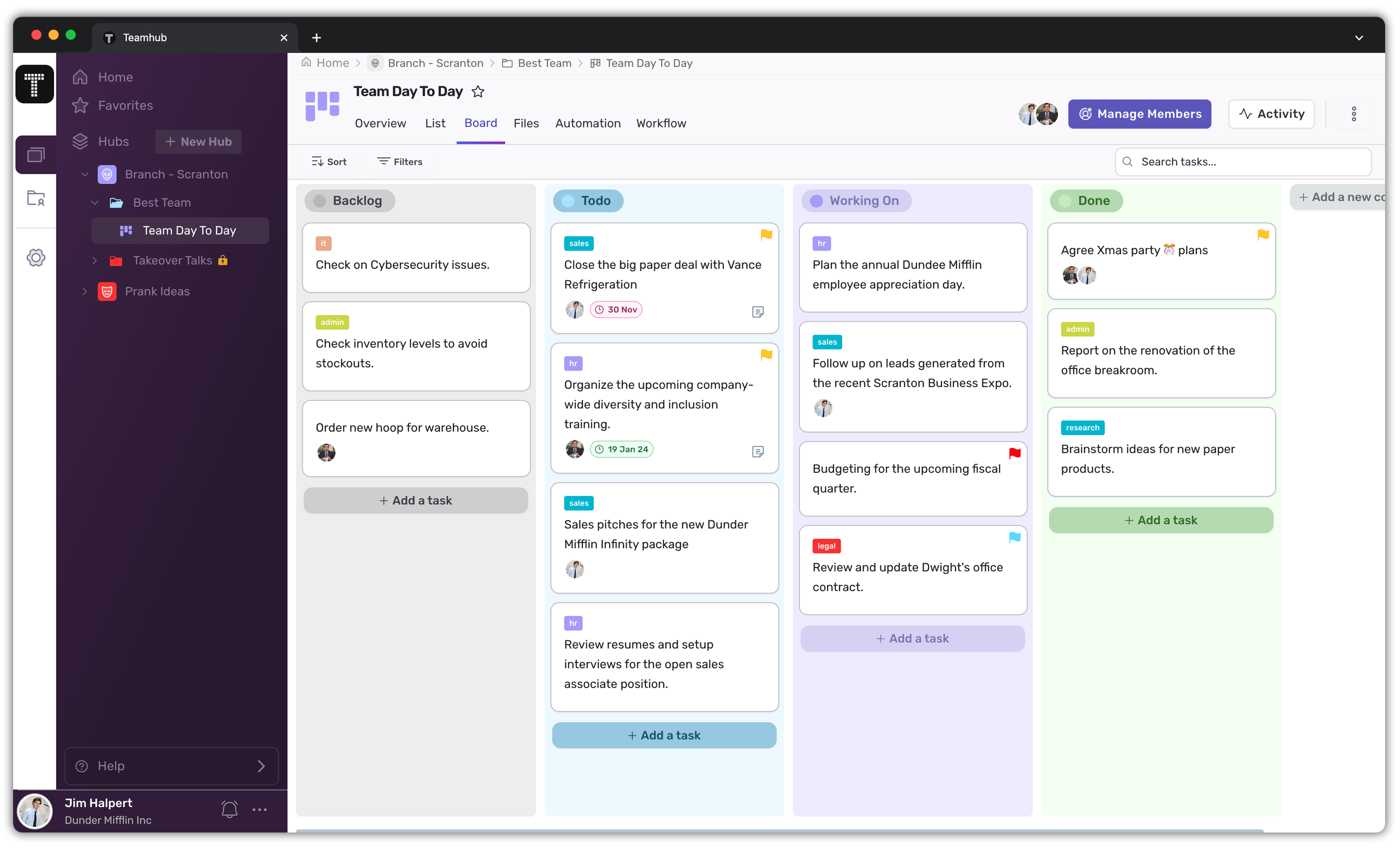

Furthermore, Agile project management promotes transparency and visibility throughout the project. By using tools such as Kanban boards and daily stand-up meetings, team members can easily track the progress of tasks, identify bottlenecks, and make necessary adjustments. This level of transparency helps in ensuring that the project stays on track and any issues are addressed promptly.

Waterfall Project Management in Fintech

While Agile project management is widely adopted in the fintech industry, Waterfall project management still has its place, especially for projects with well-defined requirements and a linear progression. In Waterfall project management, the project is divided into sequential phases, with each phase dependent on the completion of the previous one.

One of the advantages of Waterfall project management in the fintech industry is its emphasis on thorough planning and documentation. In fintech projects, where compliance and regulatory requirements are critical, having a well-documented plan helps in ensuring that all necessary steps are followed and that the project meets the required standards.

Moreover, Waterfall project management provides a clear and structured approach, making it easier to estimate project timelines and allocate resources. This is particularly important in fintech projects where time-to-market and resource optimization are key considerations. By following a sequential approach, teams can better plan and manage their resources, reducing the risk of delays or resource constraints.

However, one of the limitations of Waterfall project management in the fintech industry is its lack of flexibility. Once a phase is completed and the project moves to the next phase, it becomes challenging to make changes or incorporate new requirements. This can be a disadvantage in a rapidly changing fintech landscape where adaptability is crucial.

In conclusion, both Agile and Waterfall project management strategies have their own advantages and are suitable for different types of projects in the fintech industry. Agile project management offers flexibility and adaptability, while Waterfall project management provides structure and thorough planning. The choice of project management strategy ultimately depends on the specific requirements and characteristics of the project at hand.

One thought on “Project Management Strategies for Fintech Companies”